0

0 0

0 0

0 0

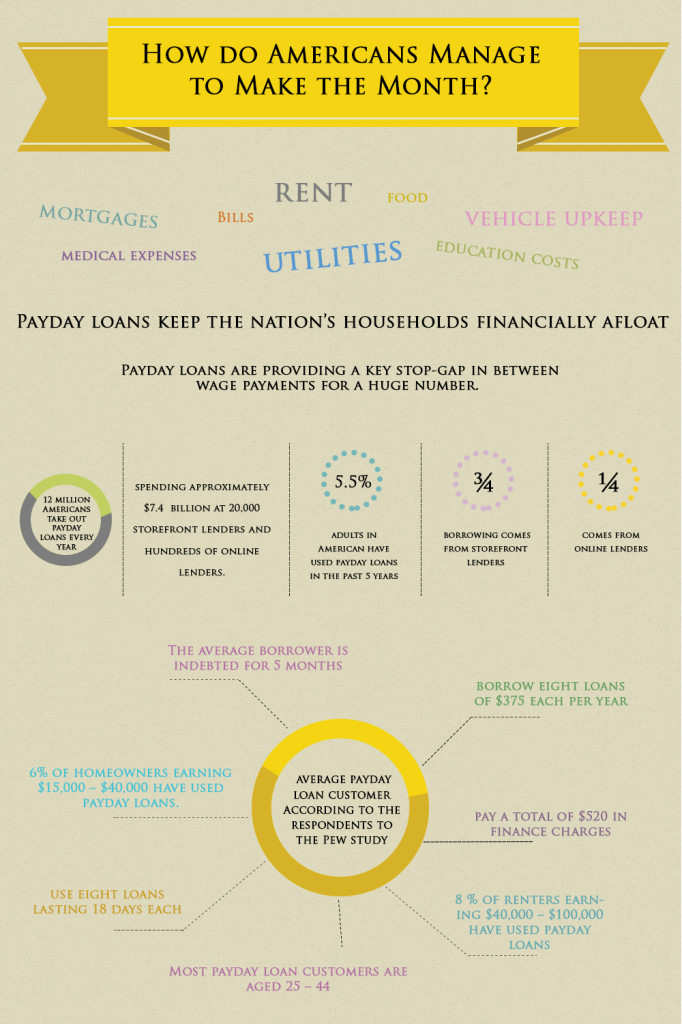

0 The daily grind of life costs money. Bills, rent, mortgages, utilities, food, education costs, vehicle upkeep, medical expenses…Those expenses can rack up at an alarming rate, not even accounting for emergencies and unforeseen circumstances that require a large payout, such as a broken car or replacing a household appliance.

The daily grind of life costs money. Bills, rent, mortgages, utilities, food, education costs, vehicle upkeep, medical expenses…Those expenses can rack up at an alarming rate, not even accounting for emergencies and unforeseen circumstances that require a large payout, such as a broken car or replacing a household appliance.

Payday loans keep the nation’s households financially afloat

So, how do hardworking Americans make the month? Payday loans are providing a key stop-gap in between wage payments for a huge number. A new study from the Pew Charitable Trusts shows that 12 million Americans take out payday loans every year, spending approximately $7.4 billion at 20,000 storefront lenders and hundreds of online lenders.

- 5.5% of adults in American have used payday loans in the past 5 years

- ¾ of borrowing comes from storefront lenders

- ¼ comes from online lenders

How do Americans Manage to Make the Month Infographic (scroll down if you want to use it on your website)

A snapshot of the average payday loan customer

According to the respondents to the Pew study:

- The average borrower is indebted for 5 months and borrow eight loans of $375 each per year

- They pay a total of $520 in finance charges

- They use eight loans lasting 18 days each

- Most payday loan customers are aged 25 – 44

- 8 % of renters earning $40,000 – $100,000 have used payday loans

- 6% of homeowners earning $15,000 – $40,000 have used payday loans.

Why do consumers need payday loans?

For the vast majority of Americans, payday loans are supplementing their incomes to cover everyday costs, rather than emergency expenses. The study shows that:

- 69% use their payday loan for utilities, credit card bills, rent, mortgage payments or food costs

- 16% use their payday loan for something unexpected, such as repairing their car or covering emergency medical expenses.

How would Americans cope without their payday loans?

With a shortfall in cash and without the ability to access payday loans, the study illustrates that:

- 81% of consumers would reduce their expenses

- Some would delay paying their bills, falling behind and risking having utilities cut off

- Others would approach friends or family for temporary financial assistance.

- A number would try to sell or pawn their possessions

- 44% would try to take a loan from a bank or a credit union

- 37% would use a credit card

- 17% would get an paycheck advance from their employer

Does the regulation of payday loans make people less likely to borrow them?

The study highlights that, within the U.S states which have stringent legal protections surrounding payday loans, there is a marked decrease in payday loan usage.

This suggests that where states either make payday loans hard to borrow (due to caps on usury or number of loans available to a borrower per year), or outright illegal, consumers will not seek out payday loans. They will, instead, find other sources for borrowing. The study shows that:

- 2.9% of adults used payday loans within the past 5 years

- This equated to 6.3% overall payday loan usage in “moderately” regulated states and 6.6% in “gently” regulated states.

- Within states that do not have storefront lenders, 5% of would-be borrowers opt for online payday loans or seek out alternative forms of borrowing such as employers or bank loans

- The remaining 95% will opt to not to use payday loans but may potentially be falling behind on their repayment obligations as a result and consequently damaging their credit scores.

What has your experience been of using cash advance options to cover a shortfall in your monthly income? Are you a regular user of payday loans? Share your thoughts with fellow readers in our comments section, below!

Download this infographic.

First of all – I am really enjoying reading these new articles in the site. Very topical issues that need attention brought to them! I have not used a payday loan before, but I would feel less shy about doing so after having read the statistics in this article. I really had no idea that so many Americans were using them. My only concern would be how to find a trustworthy online lender should the need arise?