0

0 0

0 0

0 0

0Payday loans are short term loans that are unsecured and are also referred to as payday advances or small dollar loans. Payday loan services first emerged in the United States in early 1990s and since then started on a growth climb due to a number of reasons. The financial service changes occurring in the marketplace at that time and the fact that there was a very powerful demand by consumers helped the trend.

The changes that took place in the financial service market and went on to become the basis for the growing trend of payday loans are:

- The high rise in the costs of overdraft protection fees, bounced checks, penalties that were put on late payments, and other such extensions of credit relating to short term borrowings.

- The continual trend of regulations relating to the service of payday advances that helped in the protection of consumers.

The Cash Loan Industry Analysis

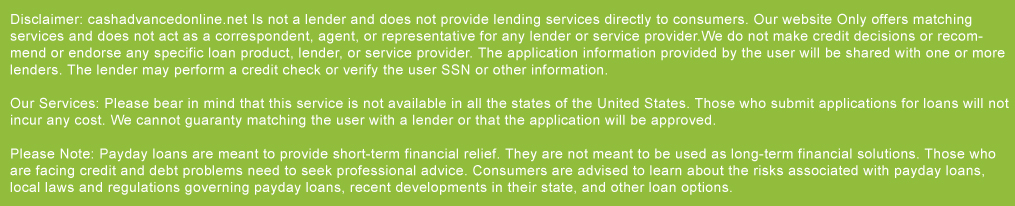

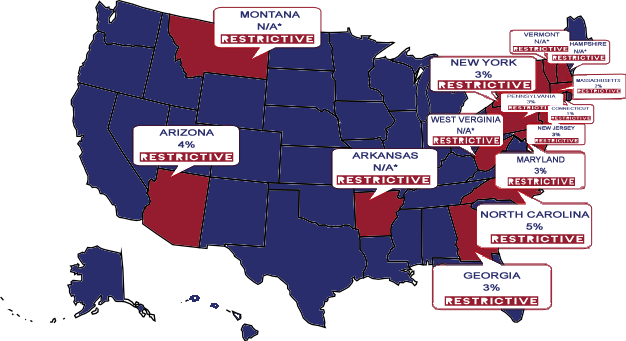

These days, payday loans are utilized for short-term borrowing needs in different communities all over America. An analysis of the industry has lead to the estimation that all over the United States, there are 20,600 payday loan locations that extend around $38.5 billion in credit relating to short term loans. These loans are utilized by working class citizens in 10 million houses who go through cash flow shortages.

The payday advance industry also significantly contributes to the American and state economies who employ a number of more than 50,000 U.S. citizens earning wages of $2 billion. This further leads to a generation of $2.6 billion and more in local, state, and federal taxes.

Because of the expansion and growth of the payday industry, Community Financial Services Association of America (CFSA) was founded so that the long run success of the industry could be ensured. More than half of the payday industry is represented by the member companies of CFSA.

There are some more quick facts about the payday loan industry and its lenders and borrowers that you can obtain by clicking here.

IBIS World can provide you with information on the payday loan industry trends and statistics, along with the market size and analysis in their market research report.

Latest Payday Loans Industry News

The payday loan industry worth $46 billion is about to suffer a major blow because new and improved payday lending regulations have been implemented by the Consumer Financial Protection Bureau. In accordance with what was mentioned in the New York Times, these new regulations are put in motion so that the lending procedures can start becoming more transparent for fair transactions.

The regulations have been put in effect because some of the payday lenders don’t play by the rules and charge interest rates in triple digits even on small loan amounts like $400. A few reasons as to why payday lenders are so difficult is because of the following:

Some States Are Still Free To Set Their Own Interest Rates

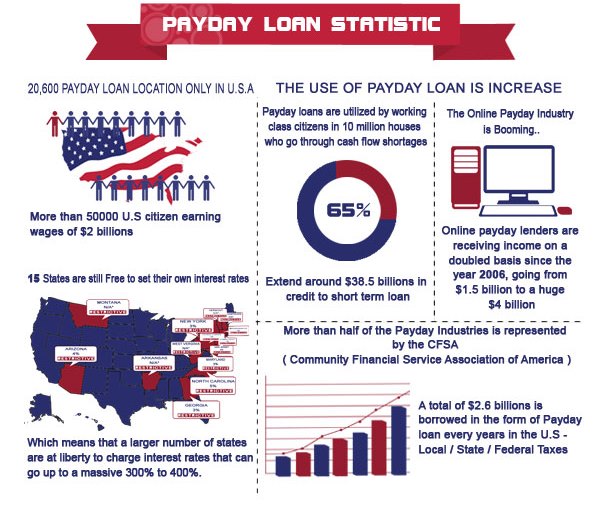

Only a small number of 15 states cap the rates of interest that are charged by payday lenders, which means that a larger number of states are at liberty to charge interest rates that can go up to a massive 300% to 400%. The State Payday Loan Regulation and Usage Rates by Pew briefly highlight the payday lending laws of each state along with a mention of their usage rates.

They Use the Internet as a Helping Hand

All thanks to the internet, online payday lenders are receiving income on a doubled basis since the year 2006, going from $1.5 billion to a huge $4 billion. By offering lending services online, the lenders can get past the tough lending laws and regulations in New York for example. These clever ways are being utilized by various lenders as an escape route from getting caught in the act of using unfair means for the purpose of payday lending.

Protecting Yourself from These Harsh Payday Lenders

If you fall victim to being harassed by these payday lenders, what you should do is immediately contact either the CFPB, or the attorney general’s office pertaining to the state you live in. They will provide you with the help you need.

Consumers require credit that can help them out instead of further harming them, and hopefully the new regulations will be a bit helpful in achieving this goal.

Need additional information click here and contact us.

Here is the Full infographic you can download and use on your website using the link below.

Download this infographic.