0

0 0

0 0

0 0

0The Law in California

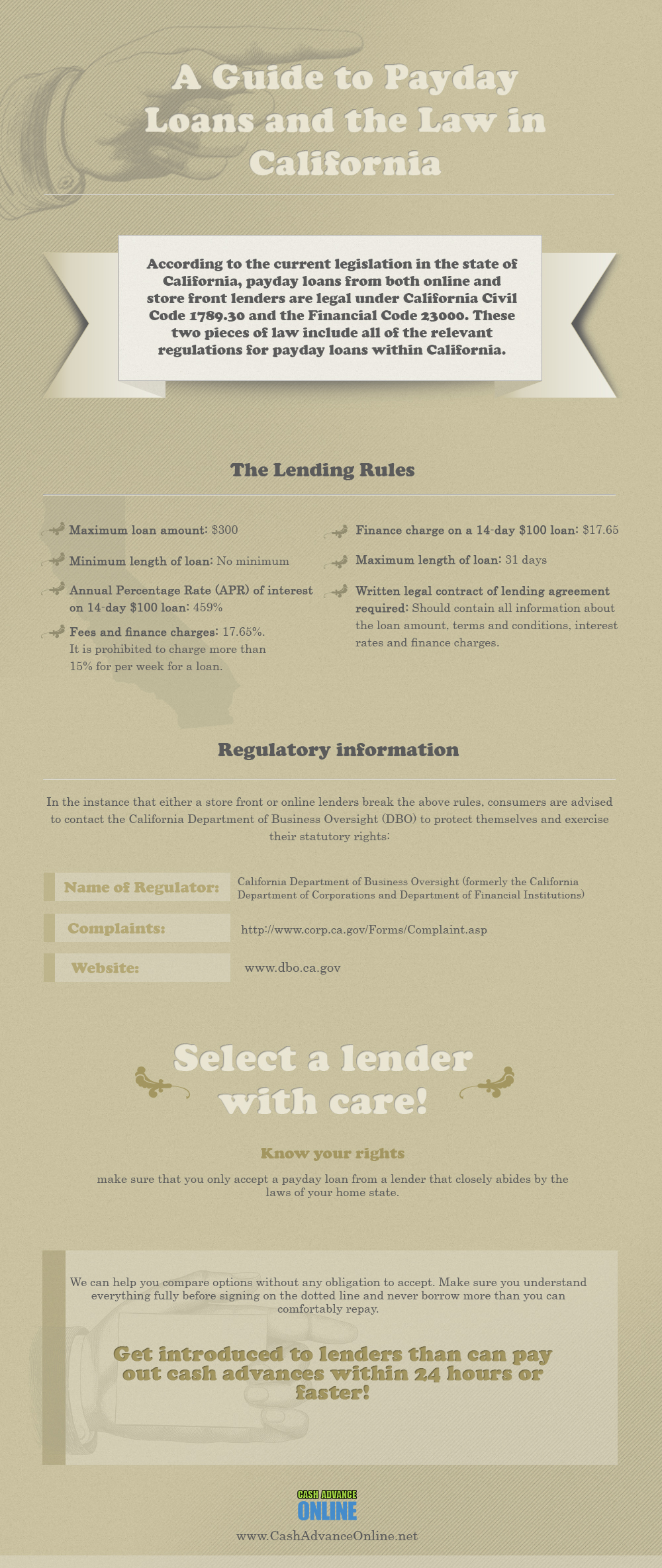

According to the current legislation in the state of California, payday loans from both online and store front lenders are legal under California Civil Code 1789.30 and the Financial Code 23000. These two pieces of law include all of the relevant regulations for payday loans within California.

Options for residents

Consumers wishing to apply for cash advances from storefront lenders within the state of California can visit the “Yell” (Yellow Pages online) website or search via Google to find a suitable company. All short term lenders in California must have a valid state license in order to operate in the state or provide residents with loans. CashAdvanceOnline.net can help connect consumers with well-established and professional online lenders that act in strict accordance with all state and federal rules.

Consumers wishing to apply for cash advances from storefront lenders within the state of California can visit the “Yell” (Yellow Pages online) website or search via Google to find a suitable company. All short term lenders in California must have a valid state license in order to operate in the state or provide residents with loans. CashAdvanceOnline.net can help connect consumers with well-established and professional online lenders that act in strict accordance with all state and federal rules.

California Payday Laws Infographic (scroll down if you want to use it on your website)

The Lending Rules

The following lending rules must be compiled with:

- Maximum loan amount: $300

- Minimum length of loan: No minimum

- Maximum length of loan: 31 days

- Fees and finance charges: 17.65%. It is prohibited to charge more than 15% for per week for a loan.

- Finance charge on a 14-day $100 loan: $17.65

- Annual Percentage Rate (APR) of interest on 14-day $100 loan: 459%

- Written legal contract of lending agreement required: Should contain all information about the loan amount, terms and conditions, interest rates and finance charges.

The Debt Limits

In order to help a consumer manage their borrowing responsibly, the following debt limits must be adhered to in California for payday loans:

- Maximum loan amount from a single lender: One payday loan per consumer at any time.

- Maximum number of rollover loans allowed: None. A consumer must completely repay their one loan before taking out another. Similarly, charges for rollovers are considered illegal in California.

- Prohibition on taking one loan to repay another: A second loan cannot be taken out to repay the first.

- Repayment plan availability: Yes

The Collection Restrictions

In addition, there are certain additional collection restrictions places against lenders in the instance of a borrower’s repayment bouncing or their failure to repay part, or all, of their loan:

- Maximum collection fees: $15 maximum non-sufficient fund fee for the return of a check.

- Criminal proceedings: In the case of a returned check due to insufficient funds, a lender is not permitted to take any criminal proceedings against the borrower.

Regulatory information

In the instance that either a store front or online lenders break the above rules, consumers are advised to contact the California Department of Business Oversight (DBO) to protect themselves and exercise their statutory rights:

- Name of Regulator: California Department of Business Oversight (formerly the California Department of Corporations and Department of Financial Institutions)

- Complaints: File a complaint here

- Website: www.dbo.ca.gov

Select a lender with care

Know your rights – make sure that you only accept a payday loan from a lender that closely abides by the laws of your home state.

Payday loans are a tried-and-true way to boost your cash flow in an emergency. However, it is important to not accept a loan before you have thoroughly considered all of the terms and conditions, such as the interest rates and charges that will apply.

We can help you compare options without any obligation to accept. Make sure you understand everything fully before signing on the dotted line and never borrow more than you can comfortably repay.

Get introduced to lenders than can pay out cash advances within 24 hours or faster!

Download this infographic.