0

0 0

0 0

0 0

0 Bloomberg has compiled a special report entitled The Future of Retirement in which a broad selection of Americans are asked about their expectations and fears for retirement. Amongst all of the survey’s respondents, almost all of them expressed their need to continue working for as long as possible in order to have enough funds to last throughout their golden years. Similarly, in a recent survey by BlackRock, investors expressed worries about outliving their assets, as more people live 9 or even 10 decades.

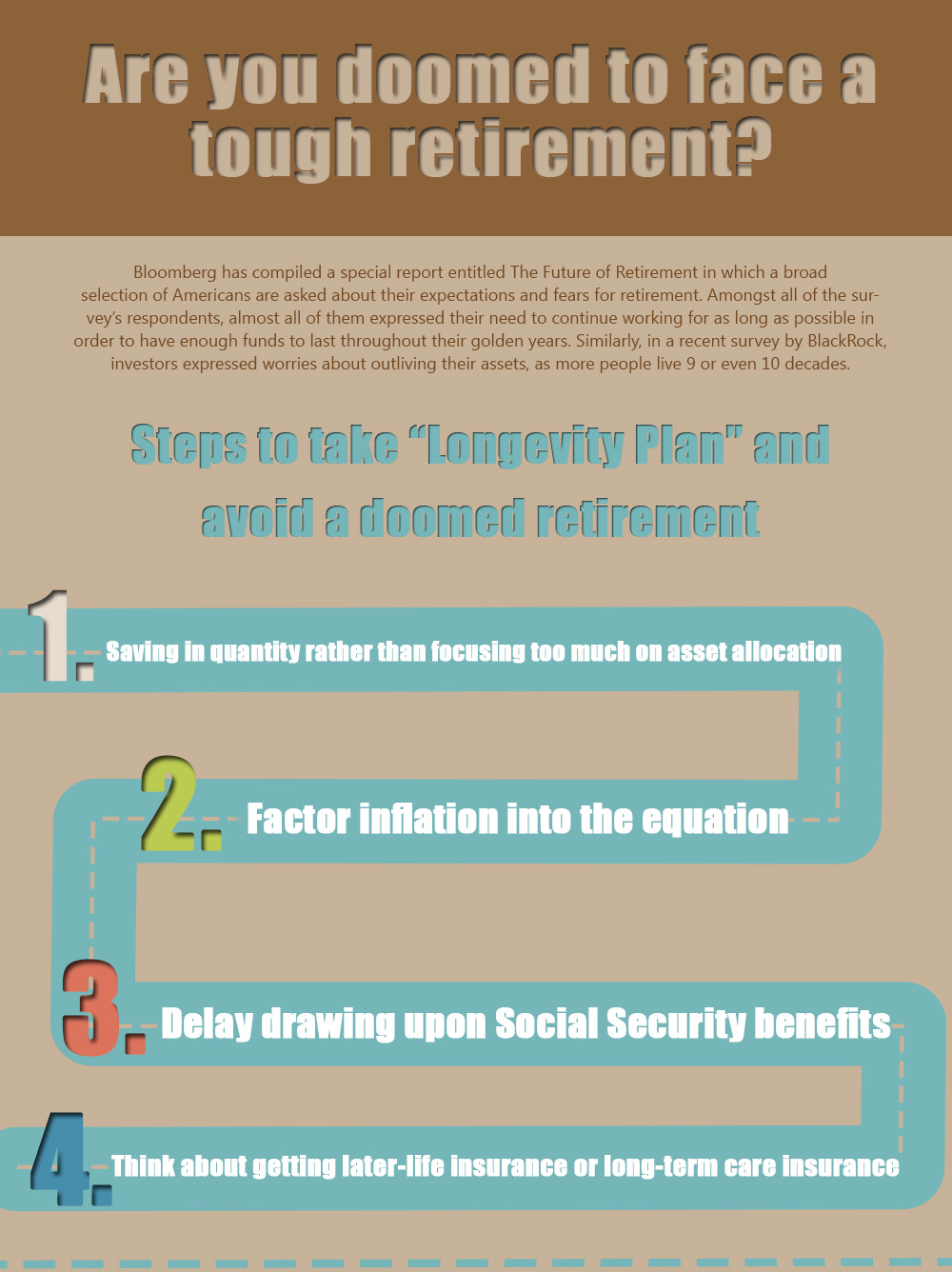

Bloomberg has compiled a special report entitled The Future of Retirement in which a broad selection of Americans are asked about their expectations and fears for retirement. Amongst all of the survey’s respondents, almost all of them expressed their need to continue working for as long as possible in order to have enough funds to last throughout their golden years. Similarly, in a recent survey by BlackRock, investors expressed worries about outliving their assets, as more people live 9 or even 10 decades.

Early retirement a thing of the past

With life expectancy growing year by year and the older population of the United States similarly increasing as result, the concept of early retirement is fast becoming a dream for many. However, there are ways the Americans can start to law down plans to safeguard any many non-working years as possible for their retirement.

face a tough retirement Infographic (scroll down if you want to use it on your website)

Steps to take “Longevity Plan” and avoid a doomed retirement

1) Saving in quantity rather than focusing too much on asset allocation: The amount of money saved in preparation for retirement and making sure that it lasts as many years as possible is much more important than the mix of assets (i.e. the combination and balance of growth and income). In fact, according to the American Society of Pension Professionals and Actuaries Journal, how much you are able to save is 5 times as important as decisions you might make about allocating assets.

2) Factor inflation into the equation: Inflation is a risk aspect that should be considered when saving or investing for retirement. Of the two risks that can threaten investment, shallow risk and deep risk, inflation is a deep risk as it has the highest chances of seriously affecting ones investments and life in turn, through losing capital. The risk can be mitigated by having a savings and investment portfolio that is global – therefore, not at the behest of one single country’s inflation. Also incorporating a value tilt and a small amount of hedge fun allocation, including something called Treasury Inflation Protected Securities (TIPs) is a good way to protect assets and savings from the effects of inflation in years to come.

3) Delay drawing upon Social Security benefits: It is also a good idea to delay drawing upon Social Security benefits in order to help hedge against the decimating effects of inflation. For each year that passes from an American’s full retirement age of 66 or 67 depending on the age they were born, up to 70 years of age benefits actually increase by 8%, adjusted for inflation.

4) Think about getting later-life insurance or long-term care insurance: Living longer means accounting for the possibility for long-term care costs, which are high and expensive. Taking out long-term care insurance is an excellent idea although it is expensive. However, its expense is of course much cheaper than the cost of self-insuring long-term care 100%. The industry is on the decrease, as it is considered unprofitable due to the much longer life expectancy of Americans. That said, some companies that still offer this type of insurance include John Hancock Financial Services, which is a unit of Manualife Financial Corporation, MedAmerica, the Massachusetts Mutual Life Insurance Co. and Mutual of Omaha. Note that the longer a consumer waits to buy, the more the policy will cost, but married couples can oftentimes receive discounts of as much as 30% of two policies are purchased at the same time. For example, a policy for a couple of 60 year olds may cost $3,500 per year versus $2,500 each person if bought separately. But for a couple in their 50s, the premium could be much cheaper, at $2,000 per year.

Are you concerned about planning adequately for your retirement? What measures are you taking to ensure you and your family will be able to retire in comfort? Share your tips and concerns with our readers by leaving comments, below!

Download this infographic.